Over the course of a century — from the 1907 bank panic that led to the creation of the Federal Reserve in 1913 through the 2008 financial crisis that spurred the 2010 Dodd–Frank Wall Street Reform and Consumer Protection Act — each banking crisis was followed by legislation and regulation intended to end them once and for all.

Yet, bank failures, and even a scent of panic at times, have been in the news again in recent months.

Each bank crisis had idiosyncratic causes and features, but the current distress in the banking industry bears some uncanny resemblance to the banking crisis and — even more worrisome — the savings and loan, or so-called thrift industry, crisis of the 1980s.

The thrift crisis was a multistage collapse and perhaps a worst-case scenario. But its main phases and features provide lessons for understanding fundamental economic forces at work today.

Disintermediation

The 1970s were characterized by an escalating inflation-recession cycle. As inflation increased, so too did market interest rates, particularly when the Federal Reserve moved aggressively — albeit at first inconsistently — to curtail monetary stimulus between 1979 and 1982.

Thrifts were specialized financial institutions. They raised funds primarily from household savings accounts and certificates of deposit, and they were required to invest primarily in residential mortgage loans and mortgage-backed securities.

In the 1970s, thrift and bank deposit yields were subject to regulatory caps meant to limit interest rate competition and protect profits.

The rate on thrift passbook savings accounts, for example, was 5.5%. But market rates increased — yields on risk-free three-month T-bills reached as high as 16.3% in 1981. Hundreds of billions of dollars flooded into money market mutual funds.

Deposit rates were deregulated under legislation in 1980.[1] Thrifts could then compete more effectively for funds, but the average cost of those funds rose as high as 12.7% in mid-1981.[2]

Interest Rate and Duration Risk

As anyone who has seen “It’s a Wonderful Life” understands, thrift deposits were not kept in a vault. One way financial institutions can meet deposit outflows is by selling assets.

There is a secondary market for mortgage loans and securities, but, as illustrated by Silicon Valley Bank’s recent experience selling so-called risk-free Treasury securities, the harsh math of financial economics dictates that when interest rates increase, the market values of even the most creditworthy fixed-rate assets decline.

Mortgages typically were 30-year, fixed-rate loans. Not until interest rates had increased to unprecedented levels in 1981 — far too late to protect thrifts from the consequences — were federally chartered thrifts authorized to issue adjustable-rate mortgages.[3]

Borrowers typically prepay mortgages in far less than 30 years, but prepayments slowed as interest rates increased, and the economy entered a steep recession.

Many mortgages generated interest income to thrifts in the 6-8% range, while rates on new mortgages peaked at 18.5% in 1981. Then, when rates finally declined, the few households that borrowed at the high rates quickly refinanced those loans at lower rates.

Forbearance

Paying more for deposits than they earned on mortgages caused thrifts across the country to record net losses, and their net worth, aka capital, declined.

Capital enabled a thrift to withstand some losses without becoming insolvent, protected uninsured depositors — those whose deposits exceeded the maximum insurance limit — and protected the insurance fund itself.

In the thrift industry, that insurer since 1934 was the Federal Savings and Loan Insurance Corp.[4] In 1980, Congress increased FSLIC insurance coverage from $40,000 to $100,000 per accountholder.[5]

An increasing number of thrifts failed to meet their minimum capital requirement. But this was so even using the reported book values of assets and liabilities. Had thrifts been compelled to “mark to market” the value of their mortgage loans and securities, virtually the entire industry would have been exposed as insolvent.

Theoretically, if regulators had acted quickly to seize and sell or liquidate thrifts as they failed their capital requirements on a market value basis, losses to the insurance fund would be minimal. But neither law nor regulation employed such a strategy.

Indeed, an opposite “forbearance” strategy was adopted. Capital requirements were reduced repeatedly.

When thrifts failed even those reduced standards, new so-called regulatory accounting practices were adopted. Thrifts were issued net-worth certificates and income-capital certificates that had no market value but could be counted toward capital requirements. Or they were simply permitted to continue operating as zombie thrifts reporting inadequate or even negative capital.

Accounting is a tool that can reveal information about the value of assets and liabilities — or obscure such information. The ultimate accounting strategy was the so-called purchase accounting acquisition.

When one thrift paid more than the net market value of another thrift — the market value of assets less the market value of liabilities — in an arm’s length transaction, the accounting treatment assumed there must be some intangible value, e.g., the value of the thrift’s branch network or relationships with depositors and borrowers, that explained the buyer’s willingness to pay a premium.

In normal times and normal acquisitions, such accounting treatment may have made economic sense. But these were not normal times or acquisitions.

When one economically insolvent thrift, say losing $1 million per year, used purchase accounting in acquiring another insolvent and money-losing thrift, say also losing $1 million per year, the acquirer typically “paid” a price of zero.

Its accountants marked-to-market the value of mortgage loans and securities acquired, sometimes recording “discounts” of tens or hundreds of millions of dollars.

Those discounts were accreted into income over the typical expected life of the associated mortgage assets, say seven years. The logic is similar to the accretion over time into income of the discount on a zero-coupon bond.

Because the buyer was paying nothing for a business with negative, or marked-to-market, book value, an amount roughly equal to the mortgage discounts was entered on the balance sheet as intangible goodwill. The goodwill was amortized over 30 or even 40 years.

One need not be an accountant to understand where this led. Say our buyer records a $100 million discount on mortgage loans and an offsetting $100 million in intangible goodwill but accretes the discount into income over seven years while amortizing the goodwill as an expense over 40 years.

This generates an additional $11.8 million of income annually for seven years followed by 33 years of incremental annual losses of $2.5 million.

Using purchase accounting acquisitions, two insolvent, money-losing thrifts could quickly transform into one “profitable” and “well-capitalized” thrift. By the mid-1980s many thrifts were reporting dramatic turnarounds driven largely by purchase accounting effects.

Congress, meanwhile, liberalized thrifts’ investment authority to enable them to diversify further beyond mortgage assets.

Credit Risk Emerges

The U.S. economy emerged from recession in late 1982 and began an expansion that would last for eight years. But economic growth was not uniform across the country. The Southwest was hit hard by a 71% decline in oil prices between 1981 and 1986 that caused a severe regional recession. The Tax Reform Act of 1986 then caused a nationwide collapse of real estate prices.[6]

Having reduced interest rate risk, many thrifts had become exposed to substantial credit risk. Loan delinquencies soared while the value of collateral or equity investments in real estate plunged.

By the late 1980s, these losses and the end of short-term boosts to profits from purchase accounting acquisitions laid bare the scope of the crisis, which the U.S. General Accounting Office, later renamed the U.S. Government Accountability Office, estimated cost $160 billion to resolve.

A Decade of Litigation

In 1989, Congress enacted the Financial Institutions Reform, Recovery and Enforcement Act.[7] Among other reforms, FIRREA required the implementation of tangible capital standards. Hundreds of thrifts could not meet the new standards and were seized and liquidated by the later-terminated Resolution Trust Corp.[8]

About 120 thrifts that had booked intangible assets through purchase accounting acquisitions filed suit in the U.S. Court of Federal Claims claiming breach of contract — in the aggregate they sought billions of dollars in damages.

In their telling, they had incurred a cost equal to the negative valuation of the acquired thrift, or thrifts, as measured by the goodwill booked in the transactions and had thus saved the government from incurring that cost had the FSLIC instead liquidated the thrifts.

Of course, the plaintiffs invariably were themselves insolvent on a mark-to-market basis and lacked the economic capacity to have provided any such benefit to the FSLIC.

Nevertheless, the plaintiffs claimed they had a contractual right to include the goodwill from the acquisitions toward meeting their capital requirements and moved for summary judgment as to the existence of a contract and FIRREA’s standards having caused a breach of contract.

The United States moved to dismiss, arguing there was no contract and that the government had sovereign immunity with respect to changes in capital requirement regulations.

The case made its way to the U.S. Supreme Court as United States v. Winstar[9] on purely legal grounds and without the benefit of discovery or economic analysis. The court ruled there was a contract enabling the thrifts to include goodwill in meeting their capital requirement, and that the United States was liable for breach of contract as a result of FIRREA.

Justice David Souter’s opinion reasoned there must have been a contract, because “[i]t would … have been madness for respondents to have engaged in these transactions with no [contractual] protection … for the very existence of their institutions would then have been in jeopardy from the moment their agreements were signed.”

But the reality in at least many of such cases was exactly the opposite: Confronting severe economic conditions and their own precarious situations, it would have been madness not to buy time using the purchase accounting acquisition strategy in hopes that interest rates would decline soon enough to rescue the combined thrift, even lacking any contractual assurance that the resulting goodwill might no longer count toward regulatory capital nearly a decade later.

Epilogue

Winstar-related litigation stretched into the mid-2000s, just in time for the spectacular run-up and crash of subprime and other residential real estate and mortgage security markets culminating in the 2008 financial crisis.

Litigation surrounding losses on loans underlying mortgage securities lasted for another decade. Now, decades after the thrift crisis, there are alarming echoes from the past. Inflation soared, then interest rates.

Silicon Valley Bank was unprepared for deposit outflows and did not control its interest rate risk. Selling fixed-rate securities forced it to recognize huge losses.

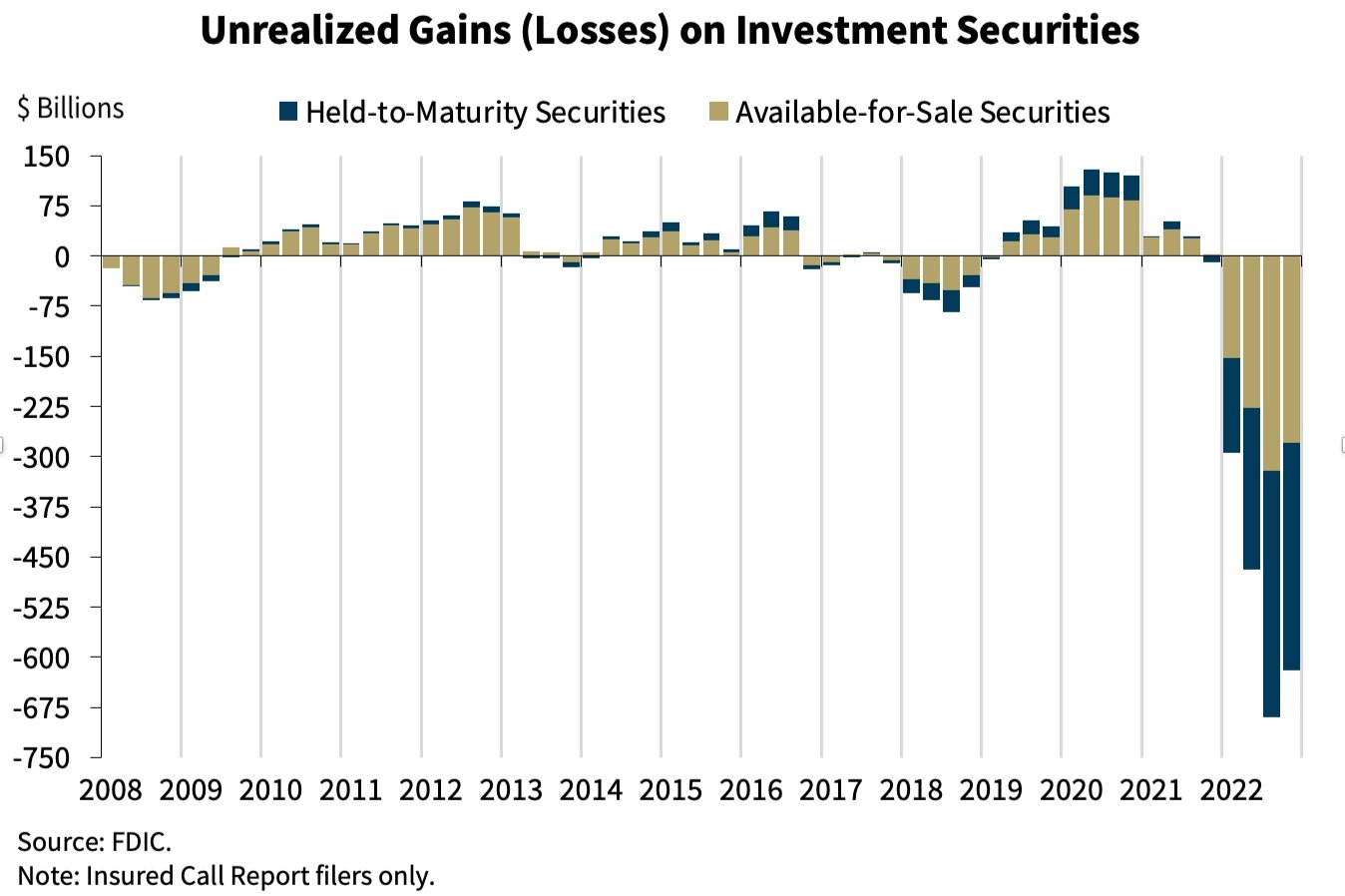

But the economic losses were there even before they were recognized by the accounting. 2023 began with U.S. banks holding assets with embedded, unrecognized losses of about $620 billion.[10] Hundreds of banks may be at risk.[11]

As in the past two crises, deposit insurance has effectively been increased, but by regulatory fiat and most clearly for large banks while smaller banks continue to fight deposit loss by increasing yields. The Federal Reserve has implemented a type of forbearance, permitting banks to borrow from the Fed using the par, or book, value of bank assets as collateral, not the depressed market value.

Meanwhile, clouds gather with respect to credit risk. The pandemic’s effects on commercial real estate are gradually materializing as leases come up for renewal, while much office space remains unused. Crypto-related losses and risks add to the disquiet.

Litigation lasted for years followed both the thrift crisis and the 2008 financial crisis notwithstanding the fact that the risks being assumed by future plaintiffs were well understood at the time they made their investments. It is worth considering what risks have been assumed in recent years by investors who may later claim to be shocked to discover them only after losses are recognized.

The opinions expressed are those of the author(s) and do not necessarily reflect the views of the firm.

[1] Depository Institutions Deregulation and Monetary Control Act of 1980. See, https://www.federalreservehistory.org/essays/monetary-control-act-of-1980.

[2] https://www.fhlbsf.com/export-cofi-history/monthly-cofi.

[4] The FSLIC was abolished in 1989 and responsibility for loan deposit insurance was transferred to the FDIC. See, https://www.federalreservehistory.org/essays/savings-and-loan-crisis.

[5] See, https://www.federalreservehistory.org/essays/savings-and-loan-crisis.

[6] “Destroying Real Estate Through the Tax Code,’ The CPA Journal Online, June 1991, https://crab.rutgers.edu/users/mchugh/taxes/Destroying%20real%20estate%20through%20the%20tax%20code_%20(Tax%20Reform%20Act%20of%201986).htm.

[7] See, https://www.federalreservehistory.org/essays/savings-and-loan-crisis.

[8] See, https://www.federalregister.gov/agencies/resolution-trust-corporation.

[9] United States v. Winstar Corp., 518 U.S. 839 (1996), decided July 1, 1996, U.S. Supreme Court.

[10] https://www.fdic.gov/news/speeches/2023/spmar0623.html

[11] Erica Jiang, Gregor Matvos, Tomasz Piskorski, and Amit Seru, Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?, Stanford Graduate School of Business Working Paper (March 2023), https://www.gsb.stanford.edu/faculty-research/working-papers/monetary-tightening-us-bank-fragility-2023-mark-market-losses.